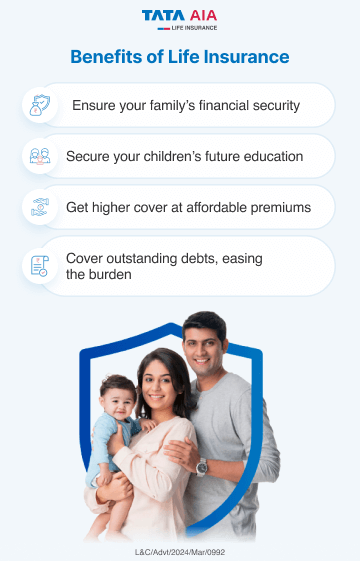

Life Insurance is a formal agreement between you and an insurance company. Here, the company agrees to provide a specified amount to designated beneficiaries upon the insured person's passing. The policyholder needs to pay regular premiums to maintain coverage. In exchange ...Read morefor these premium payments, the policyholder secures protection for their family.

Some policies may provide additional benefits, such as payments in case of serious illness or potential returns at the end of your contract term. These policies help secure your family by providing required finances during difficult times and allow them to stay financially stable once you pass away. Read less

FOR EXISTING POLICY

FOR EXISTING POLICY  1860 266 9966

1860 266 9966

FOR NEW POLICY

FOR NEW POLICY